In 2022, according to the latest U.S. Census Bureau data, 44% of American renters allocated 30% or more of their income to housing costs, with 23% spending at least half of their income on housing. This level of expenditure classifies them as “cost burdened” by the Department of Housing and Urban Development’s standards. Traditionally, it’s been suggested that households should spend no more than 30% of their income on housing to ensure enough remains for other essential expenses. However, some experts believe this benchmark needs updating to better account for current costs of living, household variations, and other relevant factors.

Renters are generally found more frequently at the lower end of the economic spectrum, as highlighted by the Federal Reserve’s 2019 Survey of Consumer Finances. In that survey, 61% of the lowest income quartile and 88% of individuals whose net worths fell below the 25th percentile were renters. Conversely, only 10.5% of individuals in the highest income quartile rented their homes.

According to a Pew Research Center analysis from August 2021, based on U.S. Census Bureau data, rental households tend to include younger Americans and those identifying as Black or Hispanic. In 2021, 35% of U.S. households were renter-occupied. Among these, 57% of households headed by Black adults and 52% of Hispanic-led households rented their homes, compared to 26% of those led by non-Hispanic White adults.

The propensity to rent is particularly high among Americans younger than 35, with 62% of this demographic living in rented accommodations. This percentage declines with age, as seen with 39% of those aged 35 to 44, and 30% of the 45 to 54 age group being renters.

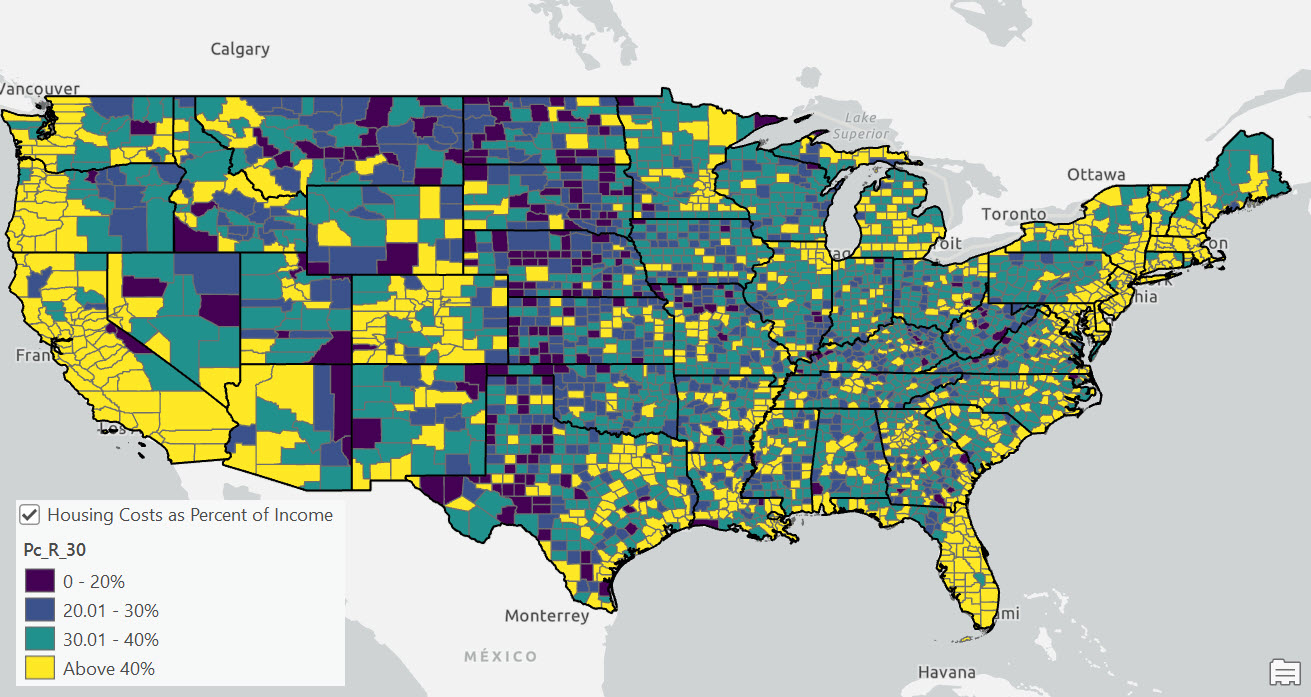

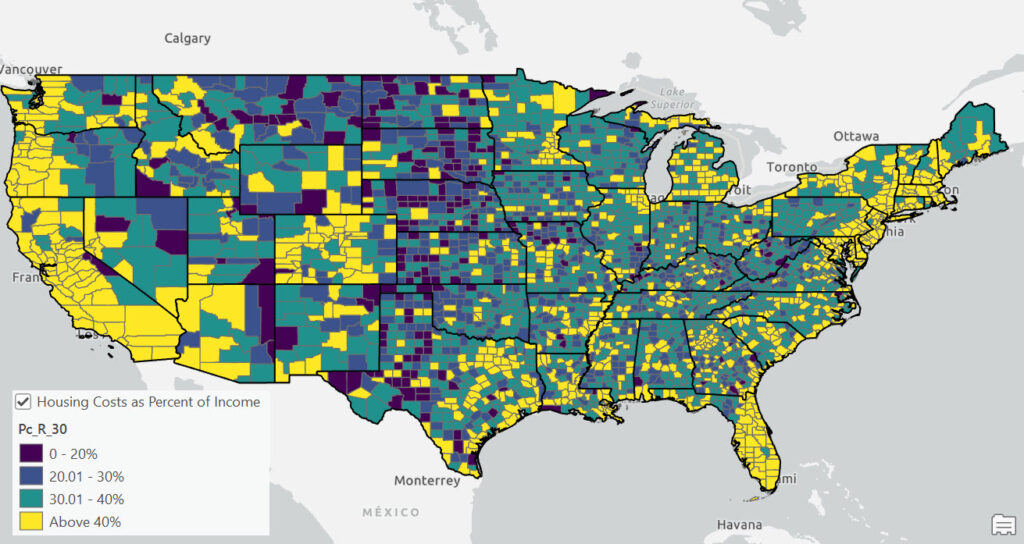

Mapping the Spatial Distribution of Rent Burden

Using an R script (you can download the script) that takes advantage of the tidycensus package, census data from 2022 (ACS data) was extracted into a data frame and manipulated to produce county and tract level shapefiles that were then mapped in ArcGIS pro to produce maps of the lower 48 states depicting the spatial distribution of renters paying in excess of 30% and 50% of their income on housing.

This first map displays the spatial distribution (at a county level) of the percentage of renters paying more than 30% of their income on rental housing. As expected, almost all counties in coastal regions have more than 40% of the rental population paying in excess of 30%, but this phenomenon is widespread across the country with large sections of Colorado, Texas, Michigan, Arizona, Florida, and several southern states exhibiting the same pattern.

If we zoom in to the Denver metropolitan area we can see just how widespread this situation is at a census tract level.

This same pattern is present in many large metropolitan areas of the United States, but is less widespread in other areas like Austin, TX.

Nationwide we found that as of 2022 roughly 44.5% of renters are paying more than 30% of their income to rent. This is indicative of significant pain for lower income groups.

If we expand the analysis we found that a whopping 22.6% of the population is paying in excess of 50% of income to rent with this being most prevalent in California, Colorado, Oregon, New York, Florida, Washington, Michigan and several southern states.

Summary

The data presented underscores a significant and persistent challenge in housing affordability across the United States. The alarming percentages of renters, particularly among demographic groups traditionally marginalized economically, indicate a systemic issue that extends beyond mere market fluctuations. The situation is exacerbated in coastal regions and major urban centers where the cost of living continues to rise disproportionately compared to income levels. This analysis, powered by the latest U.S. Census Bureau data and visualized through advanced mapping techniques, reveals a troubling landscape where a substantial portion of the population is not just burdened by high rental costs but is teetering on the edge of financial precarity.

The findings call for a multi-faceted response that includes revisiting housing affordability benchmarks, enhancing support for low-income renters, and implementing policy measures aimed at increasing the supply of affordable housing. As the maps demonstrate, the rent burden is a widespread issue affecting diverse communities across the nation. Addressing this will require not only local and state interventions but also a coordinated federal response to ensure that living standards do not continue to decline for millions of Americans. It is imperative for policymakers, community leaders, and stakeholders to consider these insights as they craft strategies to mitigate the housing affordability crisis and foster communities where everyone has the opportunity to live without the disproportionate burden of housing costs.